Top 3 reasons why you should start investing with StashAway today!

This article was posted sometime back in early 2021 and may be outdated. Refer to SingSaver instead for updated information.

This post is not sponsored, and does not constitute financial advice of any form (I bet you know better than me). Read at your own discretion.

Signing up on StashAway (a robo-advisor platform) back in the early 2020s was the first step in taking control of my financial health. Before that, 100% of my cash was just sitting in a POSB Savings account, growing at an incredibly pointless rate of 0.05% per annum. I might as well have kept the money under my mattress.

Backstory

I was hesitant to invest for years because I used to think any form of investment was risky. Like most some Singaporeans, I am was kiasi. I was afraid of the unknown. What eventually changed my mind was chancing upon this article: The big problem (of) playing it too safe with money in our 20s by thewokesalaryman, and the following quote:

Ironically, by not taking any risks and letting all your money get eroded by certain inflation, you are actually doing the riskiest thing.

This quote was the wake-up call for me to start investing, and could be yours too if you are someone who is privileged enough to start doing the same (i.e. you have the financial ability to buy bubble tea at least once a week).

Photo by my bubble-tea buddy Elsie Lee

Pictured (from left): Milksha's Fresh Milk, and Izumo Matcha Milk with Honey Pearls

Is Milksha a buy? Milksha isn't cheap by any stretch but you can't put a price tag on happiness ⭐

Buy Milksha coupons from Shopee beforehand to get massive discounts!

Anyhow, I reasoned the best way to kick-start my investment journey would be with a robo-advisor platform, given how beginner-friendly it is, how low the commission fees are, and how lazy I am given the passive and minimal-effort investment a robo-advisor offers.

You can check out this page by dollarsandsense giving an introduction to robo-advisors for more reasons why you should or should not invest with a robo-advisor platform.

I ended up choosing StashAway as my platform of choice, and here are the top 3 reasons why!

1. StashAway's all-star C-suite

StashAway is led by an "Expert Investment Team" (their words not mine) made up of the following co-founders:

- Chief Executive Officer Michele Ferrario, a former CEO of Zalora Group and the co-founder of Rocket Internet

- Chief Investment Officer Freddy Lim, a former Managing Director and Global Head of Derivatives Strategy at Nomura

- Chief Technology Officer Nino Ulsamer, the co-founder and former CTO of a now-defunct (oops) software solution company for e-commerce analytics

These guys have real, solid credentials. They are far more experienced in investing than an amateur like me (surprise surprise), and this assured me that my investments in StashAway would be handled by well-informed and secure hands.

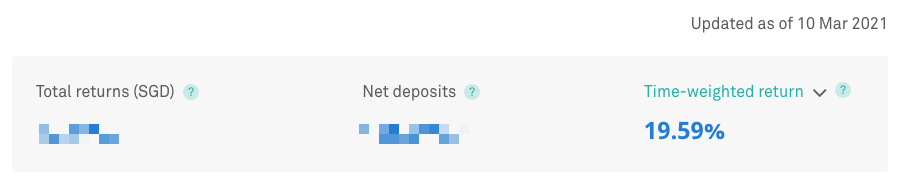

Credentials aside, they also have a proven track record of high returns for most of their portfolios. Despite how volatile and uncertain 2020 was, I achieved an impressive 19.59% time-weighted return for my portfolio of StashAway Risk Index 22%, between 3rd of February 2020, and 10th of March, 2021.

To find out how well StashAway's portfolios performed at other risk-levels, check out their article: Our Returns in 2020.

2. No minimum amount at all

Another robo-advisor platform I was considering at the time was EndowUs. However, I ultimately went with StashAway because while EndowUs had a minimum investment amount of $10,000.00 (added cents for emphasis), StashAway had no minimum amount at all. This is still the case as of 11 March 2021.

As someone new to investing, the decision to invest $10,000 all at once was too intimidating for me to make. More importantly, I was still a student back then, one who did not have that many digits in his bank account. Therefore, StashAway was a natural choice for its low entry barrier!

3. My money is safe

Naturally, I was concerned about how safe using StashAway would be. More specifically, I was worried about losing my initial investment of $100 in StashAway, in the event of StashAway filing for bankruptcy. As it turned out, it was an unfound concern given that:

Your money is kept entirely separate from StashAway's finances. To ensure that we never touch your money, we use custodian banks that hold your money, whether it's in cash or in securities.

In these custodian institutions, your assets are always in a segregated account-- one that is separate from StashAway's operations and assets. This means that you will always have full access and claim to your assets no matter what happens to StashAway.

You can read more about StashAway's Frequently Asked Questions here. Do your own research hor!

Closing note

I hope you found this post/rambling/thing (*gestures wildly at everything) insightful in any way. If you are still interested in StashAway, but not entirely convinced by me (I’ll try not to take it personally), you can check out this video by Kevin Learns Investing. All the best with getting financially fit!

Special thanks to Vanessa Tay for editing this!